INDEX

01. OVERVIEW

Resource principles

In the Offline Apportionments routine (CTBA270), the following information is available:

- Header data: Apportionment code (Automatic), Description, Type (Transactions in the Month or Accrued Balance), Base Percentage, and Blocked.

- Source data: Accounting entities used for making up the balance to be apportioned.

- Line item data: Accounting entities used in the line item of the apportionment entry to be generated.

- Target data: Accounting entities, percentages and values that will be used to generate the apportionment entries.

In the Apportionment Group, the types of apportionment will be used to define the information in this record, as follows:

- Source type apportionment:

This data defines the number of apportionment records to be generated and which make up entities that determine the balance to be apportioned.As one (1) offline apportionment record is required for each source, an apportionment record will be generated for each combination of the source type apportionment group.

- Target type apportionment:

This data defines the entry rows of the offline apportionment.Through the combination of target-type record, for each accounting entity, the number of detail rows, accounting entities used, and their respective apportionment percentages will be defined.

- Apportionments of the same type

The combination of apportionments of the same type generates an entity matrix whose structure will be the Cartesian product of the combination between the individual entities of each group.

02. EXAMPLE

1. To register the Offline Apportionment (CTBA270), go to: Management Accounting> Updates> Apportionments> Offline Apportionments> Offline Apportionment

In this example, we use only one entity.

All source entities can be combined by registering the apportionment: Ledger Account, Cost Center, Accounting Item, Value Class, and Additional Entities.

To add the Offline Apportionment (CTBA280) or Offline Apportionment Combinations (CTBA281), the CTQ table (Offline Apportionment) must contain the key of combinations of source entities, that is, from where it will extract the balance of the CQ Tables.

Source: This indicates the account to be apportioned

2. Offline Apportionment (CTBA280) routine parameter settings

Reference Date - The apportionment accounting entries will be generated with the date you specify in this parameter.

Group of characteristics group of the apportionment accounting entry - In these parameters, the user indicates the characteristics that the generated apportionment entries will have.

Batch Number?

Sub-batch Number?

Document Number?

Default Hist. Cd? The user must have a default history record as a precondition to use this parameter.

Apportionment Record - This allows you to indicate which apportionment records will be used.

From Apportionment?|To Apportionment?

Currency Group

Currencies? (All|Specific)

All - The apportionment journal entries will be generated for all currencies.

Specific - The apportionment accounting entries will be for a currency chosen in the 'Which Currency?' parameter.

Which Currency? Currency for generating the apportionment accounting entries if you selected the previous parameter Currencies = Specific.

Balance Type? Balance type of the apportionment accounting entries.

Select Branches (Yes|No) Branch from? | Branch to?

3. Balance Control

CTBA280:

Update Balance? (At End | During)

At End - Performs balance reprocessing (CTBA190) after generating the apportionment entries in the current branch.

During - Updates the balances of the accounting entries during the apportionment processing.

CTBA281:

Reproc.Before|Between|After? |

Select in which phase to run the processing for balance updates: Before starting the apportionment, Between apportionments, and After apportionments.

This configuration has three numeric positions, XXX, one for each processing phase:

1st position - represents the phase prior to the beginning of apportionment;

2nd position - represents the phase between apportionments;

3rd position - represents the final phase of apportionments.

Each position must be filled with content 1 to reprocess or 2 not to reprocess.

Example:

111 = Reprocess balances in all phases: before start of apportionments, between them and by the end of them.

222 = Does not perform update of balances in any phase.

211 = Reprocess balances in the phase between apportionments and in the phase at the end of apportionments.

Notes

- The Offline Apportionment routine (CTBA280) does not control runs in a given period. If you perform n runs in a period, the routine will generate the apportionment entries for each run.

- The apportionments are performed by the entity's balances in the CQ tables, not by the entry made in CT2.

- If the apportionment record considers the 'Type = Monthly Transaction', the apportionment will be made over the entity's balance in the month of the reference date.

- If the apportionment record considers the 'Type = Monthly Balance', the apportionment will be made over the entity's balance in the month of the reference date.

Reprocessing Balances During

When setting parameters for balance reprocessing to be executed (during), consider that the balance is reprocessed at the end of each apportionment code execution.

If more than one apportionment code uses the same source entity, the balance to be apportioned is affected by accounting entries entered through the apportionment routine, made by the previous execution.

The same behavior occurs if two apportionment codes are set to the same source and run in isolation, independently of option reprocessing during.

Whenever you can, avoid using the same source entity in distinct apportionment codes because execution parameter settings may affect the values.

For the above scenarios, we suggest setting routine parameters to not reprocess balances during execution. Thus, the initial balance of the source entity is used as base for executing all apportionment codes containing this source entity.

4. Perform the Offline Apportionment (CTBA280) or Offline Apportionment Combinations (CTBA281):

Example:

The precondition is that the source account has a balance in the QC tables.

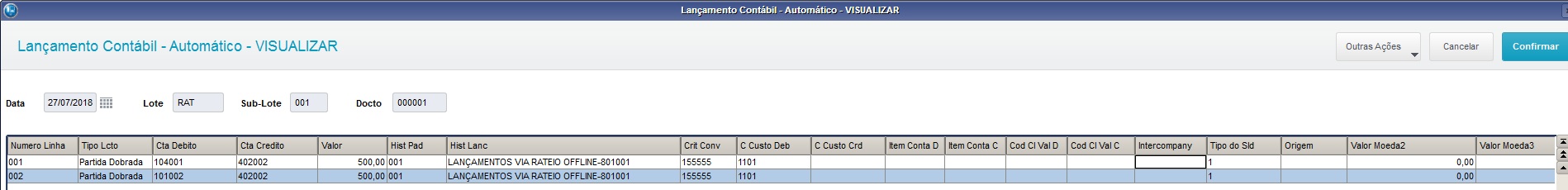

After the apportionment processes (CTBA280 or CTBA281) are run, the postings are generated.

Important

In the case of using accounting entities configured so that their use together with other entities is required, it is important that the user also enters these entities in the apportionment record in order to avoid inconsistencies when generating the apportionment entries in routine CTBA280.

Example:

Ledger account configured for mandatory use with a cost center.

Offline apportionment record with the required entity filled in.

If the required accounting entity is not entered, a warning message appears allowing the user to choose whether to continue with the process or to go back and correct the apportionment.

The confirmation of the Offline Apportionment registration (CTBA270) is allowed even with inconsistencies.

This is because you can perform an Offline Apportionment by Combinations (CTBA281) and enter the required accounting entities in this routine.

But we recommend that you correct the inconsistencies in the Offline Apportionment record itself.