| Totvs custom tabs box items |

|---|

| default | yes |

|---|

| referencia | passo1 |

|---|

| - Create a backup of the environment repository (RPO File).

- Apply the corresponding patch to the issue DUSAL-17.

- Validate that the routines included in the patch coincide with that mentioned in the "Function" section of the heading of this Technical Document, as well the dates of the files.

- Check the parameters below:

- MV_CALCDEP = 1

- MV_TIPDEPR = 4

- MV_ULTDEPR (Fixed assets depreciation last calculation date) = '20211231'

- MV_ATFMOED = 1

- Set the database to "07/03/2022".

- In the Fixed Assets module (SIGAATF), go to the Updates | Files | Currencies (MATA090).

- Must set up a rate for currency 1, for all the days of the month on which the depreciation will be made. In this case, it is configured for the whole month of July until December 2022.

- Go to the Updates | Files | Assets Group (ATFA271).

- Configure an asset group.

- Go to the Files | Assets (ATFA012)

- Click "+Add" to register an Asset. Fill in the Assets information and use the asset group above.

|

| Totvs custom tabs box items |

|---|

| default | no |

|---|

| referencia | passo2 |

|---|

| - Set the database to "0112/0131/20232022".

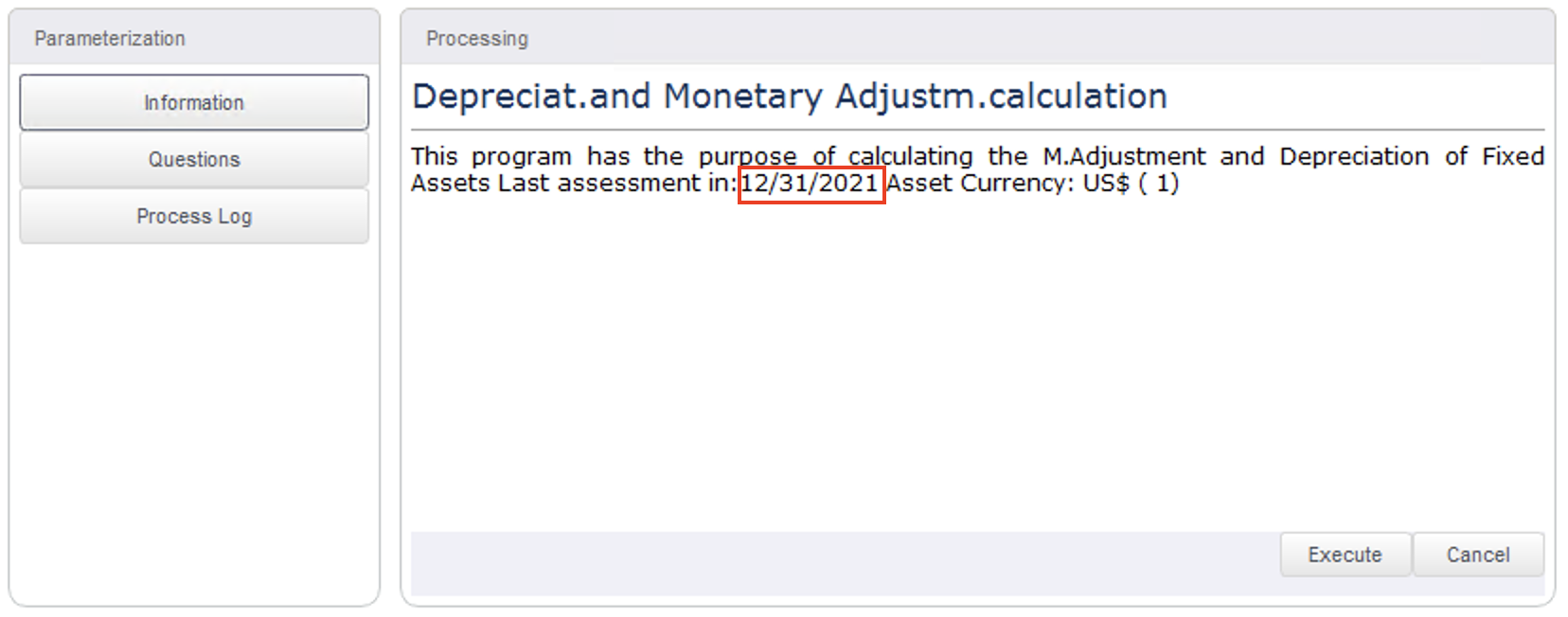

- In the Fixed Assets module (SIGAATF), go to the Miscellaneous | Processings | Monthly Calculation (ATFA050).

- The date that is recorded in the parameter (MV_ULDEPR) will be displayed in the main Window. Choose "Questions" and set all questions, after that choose "Execute".

- In the Fixed Assets module (SIGAATF), go to the Reports | Transactions | Valed Position (ATFR070).

- Set the parameters and choose "Print".

- It will be observed in the report that 6 months were considered for the asset with an acquisition date of 03/07/2022 for the calculation of the annual depreciation.

|

|