Release 12.1.22.10

This document contains the features of the tax configurator from release 12.1.22.10 onwards. For previous releases, we recommend the following documentation: CFGTRIB - Tax Configurator - 12.1.33

Product: | Microsiga Protheus® |

Versions: | 12.1.22.10 |

Occurrence: | Generic Tax Configurator |

Introduction

This feature was created to tackle the complexities of the Brazilian tax system, aiming to enable the creation of taxes in a fully configurable way. This routine gathers the main elements of a fiscal operation involving states of origin, destination, products,

Procedure for Utilization

Credit Reversal - With Product Resale

Requirements

- Environment updated to release 12.1.22.10 or above;

Registers, Configurations, Verification and Reports

The configurator of generic taxes is available on the menu of module Tax Records (SIGAFIS), on menu Updates → Facilitators → Tax Configurator (routine FISA170).

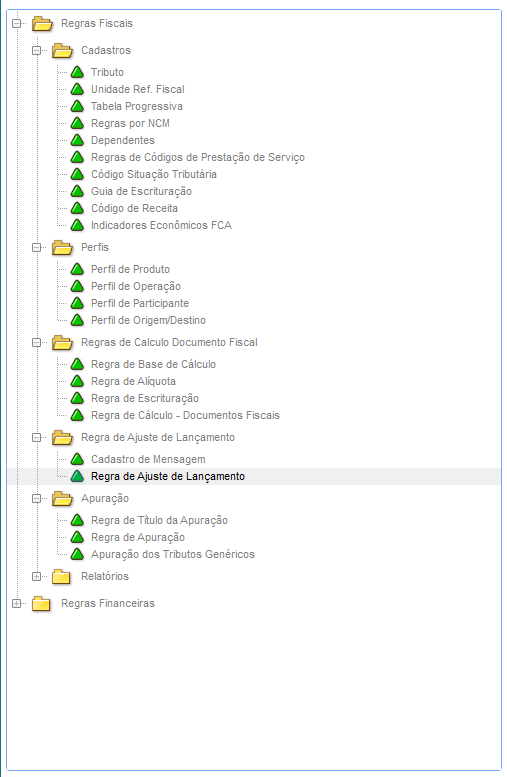

When you access the tax configurator, all registers needed for configuring are grouped and organized on the left side menu.

The routines are arranged in two main groups, Tax Rules and Financial Rules. This manual pertains the registers of group Tax Rules. For further information on the group Tax Rules, click https://tdn.totvs.com/x/NBu9Gg

Important

You can find the date and time of the routines involved in the tax configurator in Other Actions option Routine List:

This option displays the sources' date and time information:

Registers Folder

Generic Tax Register

Use this routine to register generic taxes. This is the first registration you make for the system to process a new tax.

Example

In this register, fill in the following data:

Section Tax Definition:

Tax = Through this field, set the code for the new tax. Define it at will, though you cannot repeat it. This field is required.

Description = In this field, enter the description of the new tax. Describe it as you wish, to make identifying this tax easier.

Sphere = This field specifies the sphere of this tax. The options are 1 - Federal, 2 - State or 3 - Local. This field is not required.

Kind = In this field, select the tax kind. The options are 1-Tax, 2-Contribution, 3-Fund or 4-Fee.

Section Identifier - TOTVS ID:

Tax ID = In this field, enter the code that identifies the generic tax. We call this code the TOTVS ID.

The TOTVS ID concept enables the identification of a generic tax. The system automatically generates a fixed number for this ID. This ID basically calls "From To", from a generic tax with a random code set by the user to an actual, known tax.

Only fill in this field when you need to state the value of the generic tax in an ancillary obligation, such as SPED Fiscal; otherwise, there is no need to fill it in.

Customers are notified through notices and documents every time TOTVS IDs are released, with all the required procedures.

Tax Reference Unit Register

Use this routine to register a tax reference unit, with its respective quotation, on a monthly basis.

In this register, fill in the following data:

Section URF Definition

In this section, provide data to define and identify the URF.

Unit Code: In this field, enter the identifier code. This field is required and you can register no more than one URF with the same code, because this code is used for linking with the other entities, such as the rate rule.

Description: In this field, enter the URF description. Describe it as you wish, to make identifying the URF easier.

Section URF Values:

In this section, enter URF values on a monthly basis. When calculating the tax, the URF value is obtained in accordance with the month and year of document issue.

Month: In this field, enter the reference month for the URF value.

Year: In this field, enter the reference year for the URF value.

Value: URF value corresponding to the previously entered month and year.

Progressive Table Register

Use this routine to create progressive table rules, with data from the ranges composing a given progressive table as well as deduction values and rates. For example, you can use this routine to calculate Income Tax.

In this register, fill in the following data:

Section Progressive Table:

In this section, provide data to define and identify the Progressive Table.

Code: In this field, enter the identifier code. This field is required and you can register no more than one rule with the same code, because this code is used for linking with the other entities.

Description: In this field, enter the rule description. Describe it as you wish, to make identifying the rule easier.

Section Enter Range Values:

In this section, enter range values, one at a time.

Initial Value: In this field, enter the initial value of the range.

Final Value: In this field, enter the final value of the range.

Rate: In this field, enter the rate of the range.

Deduction Value: In this field, enter the value to be deducted from the range.

Register of Rules per NCM

Use this routine to configure taxes that require base value, increase or MVA. Configuring scenarios by NCM, specifying: tax, states of origin/destination, effective period, tax classification or measurement unit of product.

In this register, fill in the following data:

Section NCM:

NCM Code: In this field, enter the NCM code. This field is required and you can register no more than one rule with the same NCM, because this NCM is used for linking with the other entities.

Description: This field is automatically filled in with the NCM description registered in Protheus.

Section Taxes:

Tax: Tax Code to be bound to the NCM rule, which may have MVA, Base Value or Rate Increase. Tax examples: ICMS, ICMS ST, IPI, PIS, COFINS and more.

Description: This field is automatically filled in with the tax description registered in the Tax Configurator.

Added Value Margin:

Source State: State of Origin. If you want all States, enter **

Destination State: State of Destination. If you want all States, enter **

Start Date: Start Date of MVA validity

End Date: End Date of MVA validity

MVA: MVA calculation rate

MVA Auxiliary Index: MVA auxiliary index

Base Value:

Source State: State of Origin. If you want all States, enter **

Destination State: State of Destination. If you want all States, enter **

Start Date: Start Date of MVA validity

End Date: End Date of MVA validity

Measurement Unit: Product measurement unit to be used for calculating the Base Value

Base Value: Base Value to be added to tax calculation

Rate Increase:

Origin State: State of Origin of a product. If you want all States, enter **

Destination State: State of Destination of a product. If you want all States, enter **

Start Date: Start Date of MVA validity

End Date: End Date of MVA validity

Increase Percentage: Percentage of Increase used for calculating FECP or Increase.

Increase Auxiliary Index: Auxiliary index for calculating Increase

When calculating the tax in Protheus routines, the Tax Configurator tries to classify the operation, if the tax has any link to the NCM register, considering: NCM, Tax, State of Origin/Destination, Effective Period and Measurement Unit.

Important!

From continuous dispatch of February/2023 onwards, in the Rule by NCM register, the Added Value Margin, Base Value and Rate Increase tabs feature a new field for specifying the CEST code to classify that rule.

This field allows a greater range of rule specification, so you may use the same NCM code to classify two different MVAs, one for each CEST code.

We must emphasize that you may leave this field blank, in which case all CEST codes of that NCM are classified in that rule.

Once a given tab has a line with a blank CEST code, you cannot add a new line with conflicting validity dates, whether the CEST code is filled in or not.

Dependents Register

Use this routine to handle all rules involving the deduction of values by dependents. We created this routine to eliminate the need for using parameters in SX6.

In this register, we basically define the deduction value per dependent, as well as the date criterion for using this deduction.

In this register, fill in the following data:

Section Enter the Rule Code:

Rule Code: In this field, enter the identifier code. This field is required and you can register no more than one rule with the same code, because this code is used for linking with the other entities.

Description: In this field, enter the rule description. Describe it as you wish, to make identifying the rule easier.

Section Rule Configuration:

Value per dependent: Deduction value per dependent, to be multiplied by the registered quantity.

Date to be used when searching the balance per dependent: Date type with which the bill related to the invoice in Financials is queried. 1 = Issue; 2 = Actual Due Date; 3 = Booking Date; 4 = No Query in Financials.

This rule is linked to the calculation index I:DED_DEPENDENTES. This index also remains available in the formula component. Primarily it must be bound to Calculation Rule - Tax Documents, though you may use it in other rules by formula, if needed. The deduction value per dependent is obtained by multiplying the value per dependent entered in the register by the quantity of dependents of the supplier. The system then checks whether the deduction value was already used on the bill's date of maturity, issue or booking. If not, the deduction is used as expected; otherwise, the value is no longer used on the same day, in accordance with the criterion adopted in the deduction per dependent rule.

Register of Service Provision Code Rules

Use this routine to set rules for obtaining the local tax rate, depending on the service provision code (SX5 - Table 60), whether local or federal, of the tax and city in which the local tax is due.

In this register, fill in the following data:

Section Service Code:

Service Code: In this field, enter the service code. This field is required and you can register no more than one rule with the same code, because this code is used for linking with the other entities.

Description: This field is automatically filled in with the service code description registered in Protheus.

Section Taxes:

Tax: Tax Code to be bound to the service code, which may have a general rate configuration for all cities or a specific configuration per city.

Description: This field is automatically filled in with the tax description registered in the Tax Configurator.

Rate: Default rate for all cities that fit the rule.

Section Specific Rate by City:

State: State that contains the specific rate by city

City Code: Code of city that contains the specific rate.

Description: This field is automatically filled in with the description of the city selected.

Specific Rate: Specific rate for the city that fits the rule.

There is no need to enter this rule code in any register. Once you configure an Operation Tax Profile that includes the ISS code, a rate rule with the calculation index I:ALQ_SERVICO in the formula and bind all configurations in Calculation Rule - Tax Documents, Protheus will be ready to try to classify the tax using the service rate at the Invoice time.

Tax Status Code Register

Use this routine to register the CSTs of several taxes, such as ICMS, IPI, PIS, COFINS and more. When you access the configurator for the first time, the system runs an automatic load based on the CSTs already found in it, with the CST codes of ICMS (generic table S2), CSOSN (generic table SG), IPI (generic table S3), ISS (generic table S9), PIS (generic table SX) and COFINS (generic table SX).

In this register, fill in the following data:

Section Tax Status Code

In this section, provide data to define and identify the CST.

Code: In this field, enter the identifier code. This field is required and you can register no more than one with the same code, because this code is used for linking with the other entities, such as the bookkeeping rule.

Description: In this field, enter the description of the new tax status code group. Describe it as you wish, to make identifying the register easier.

Tax ID: Enter the code that identifies the generic tax that will contain a tax classification procedure. This Tax ID is the TOTVS ID code mentioned in the tax register.

Start Date: Start Date of CST register validity; that is, if the tax document date is previous to the start date of validity, the register is not used for CST classification. If it is after or equal, then the register is used. This field is required.

End Date: End Date of CST register validity. Of course, this is used only when the end date is known. When the end date of validity is not known, leave it blank.

Section CST:

In this section, enter the tax classification code and its respective description for the Tax ID selected.

CST: Enter the tax classification code.

Description: Description of the new tax classification code.

Bookkeeping Form Register

Use this routine to set the form generation rules (Table SF6). In various situations, when the invoice is issued, the need arises to generate forms, something currently done in legacy taxes through questions (Dictionary - SX1) in routines MATA461 and MATA103. With this routine, it is no longer necessary to fill in questions, but rather to configure it. The customer is free to define exactly in which situation their form should be generated or not.

In this register, fill in the following data:

Rule Definition Section

In this section, provide data to define and identify the CST.

Code (CJ4_CONDIGO): In this field, enter the identifier code. This field is required and you can register no more than one with the same code, because this code is used for linking with the other entities, such as Calculation Rule - Tax Documents.

Description (CJ4_DESCR): In this field, enter the description of the new bookkeeping rule. Describe it as you wish, to make identifying the register easier.

Section Form Generation Mode:

Mode for Bookkeeping Form Generation (CJ4_MODO): Mode of tax Payment form generation. 1=Invoice and 2=Verification.

View Form When Generating the Invoice (CJ4_VTELA): Option to view the form onscreen when adding the document.

Increase Form (CJ4_MAJSEP): Enter whether to generate separate forms when generating the form, if there is a tax increase calculation.

Section Form Generation Criterion:

State of Origin and Destination (CJ4_ORIDES): Generation of tax payment form for operations: 1=Interstate Only; 2=Internal Only; 3=Neutral.

Import or Export (CJ4_IMPEXP): Generation of tax payment form: 1=Import Only; 2=Export Only; 3=Neutral.

State Registration at State of Destination (CJ4_IE): Generate form for collection at State of Destination when: 1=Has SR; 2=Lacks SR; 3=Neutral.

Section GNRE Due Date:

Due Date (CJ4_CFVENC): Due Date Option: 1=Add business days; 2=Fixed Day current month; 3=Fixed Day following month.

Quantity of Days to Add (CJ4_QTDDIA): Quantity of days to be added in accordance with the option selected in due date configuration field (CJ4_CFVENC).

Date of Fixed Day (CJ4_DTFIXA): Fixed date for GNRE due date. This field is enabled in accordance with option 2 or 3 of field (CJ4_CFVENC).

Section GNRE Complementary Information:

CNPJ/EIN (CJ4_CNPJ): Printing of participant CNPJ/EIN in GNRE.

State Registration (CJ4_IEGUIA): State registration to be printed in GNRE. 1=Participant; 2=Sigamat (Company Register in Protheus); 3=SR of State.

State (CJ4_UF): State to be used when printing the GNRE: 1=Parameter (MV_ESTADO); 2=State of Origin; 3=State of Destination; 4=Invoice State.

Add. Info (CJ4_INFCOM): Code of additional information to be recorded in the Form complement.

Description (CJ4_DESINF): Description of additional information selected in field (CJ4_INFCOM).

Revenue Code Register

Use this routine to define which revenue code to use in the National Form for Collection of State Taxes (GNRE).

During the process of recording the generic tax GNRE, the revenue code classification will be requested. Based on the user definition, revenue codes can be defined by document template and State, so no other type of binding is needed in the tax configurator.

In this register, fill in the following data:

Section Rule Definition:

Tax Code (CJ5_CODIGO): Code of tax that contains the rule for generating the revenue code. Tax examples: ICMS, ICMS ST, IPI, PIS, COFINS and more.

Description (CJ5_DESCR): This field is automatically filled in with the tax description registered in the Tax Configurator.

Section Document Templates Definition:

Document Template (CJ7_ESPECI): Kind of tax document. (SX5 - Table 42). If you want to configure all kinds, enter ALL.

Description (CJ7_DESCR): Description of tax document kind registered in generic table.

Section Code by State:

State (CJ6_ESTADO): State that contains the rule. If you want to configure all states, enter **.

Revenue Code (CJ6_CODREC): Code of Revenue. Example: 100013 - Communication ICMS.

Revenue Det. (CJ6_DETALH): Details on Revenue. If the state lacks revenue code details, this field remains blank.

Reference (CJ6_REF): Reference period. Example: Monthly, 1st Fortnight, 2nd Fortnight, etc.

FCA Economic Indicators Register

Use this routine to register FCA (Update and Conversion Factor) Economic Indicators for each State/Period.

In this register, fill in the following data:

Section FCA (Update and Conversion Factor) Economic Indicators:

State (F0R_UF): State at issue.

Period (F0R_PERIOD): Reference year and month.

Indicator (F0R_INDICE): Economic index for conversion factor.

To use this register, bind its index (I:INDICE_AUXILIAR_FCA) to a formula. Refer to Calculation Formula Details for further utilization information.

Profiles Folder

Product Tax Profile Register

Use this register to define product tax profiles in accordance with criteria set by the customer themselves, for use in the generic taxes calculation.

In this register, fill in the following data:

Product Tax Profile

In this section, enter a code and a description to identify the profile registered. Be mindful that the product profile rule code cannot be repeated.

Products

On this grid, enter which products integrate the profile. There must be at least one line on this grid. The product cannot repeat itself in the same profile, and must have at least one product entered.

Product Origins

On this grid, enter the origins that belong in this profile. There must be at least one line on this grid. The product origin cannot repeat itself in the same profile, and must have at least one origin entered.

Operation Tax Profile Register

In this routine, enter operation profiles through CFOPs, Operation Type and Service Code, following criteria set by the customer, to be used in the generic tax engine configuration.

This register has an automatic load of profile suggestions that facilitate its use.

Operation Tax Profile

In this section, enter a code and a description to identify the profile registered. Be mindful that the product profile rule code cannot be repeated.

In this register, fill in the following data:

CFOPs

On this grid, enter which CFOPs compose this profile. There must be at least one line on this grid

Type of Operation

On this grid, enter which Operation Types compose this profile. There must be at least one line on this grid.

If you need to use all operation types in the profile, you do not need to type all operation types. Just add a line to the grid with the code "ALL" for the system to automatically use all operation types.

Service Code

On this grid, enter which Service Codes compose this profile. If not a service operation profile, leave this tab blank.

Participant Tax Profile Register

Use this routine to define participant profiles to calculate generic taxes, following criteria set by the customer.

In this register, fill in the following data:

Participant Tax Profile

In this section, enter a code and a description to identify the profile registered. Be mindful that the product profile rule code cannot be repeated.

Participants

In this section, define which participants compose the participants profile through fields:

Type: Use this field to define the participant type: 1 - Supplier (SA2) or 2 - Customer (SA1)

Participant: In this field, enter the participant code. This will be a customer or supplier code in accordance with the type specified previously.

Store: In this field, enter the participant's store, whether a customer or supplier store depending on the previously specified participant type.

Note

A profile may have one or more participants, though the participant cannot be repeated in the same profile.

Register of Origin and Destination Tax Profile

Use this register to define origin and destination tax profiles in accordance with criteria set by the customer themselves, for use in the generic taxes calculation.

This register has an automatic load of profile suggestions that facilitate its use.

In this register, fill in the following data:

Origin and Destination Tax Profile

In this section, enter a code and a description to identify the profile registered. Be mindful that the product profile rule code cannot be repeated.

States of Origin/Destination

On this grid, enter the States of origin and destination that compose the profile.

Origin State: In this field, enter the state of origin of the operation.

Target State: In this field, enter the state of destination of the operation.

Note

The combination of State of Origin + State of Destination cannot be repeated within the same profile.

Tax Document Calculation Rules Folder

Calculation Base Rule Register

Use this routine to register a calculation base rule. When the tax is calculated, this rule is interpreted and the resulting value is used as calculation base.

In this register, fill in the following data:

Calculation Base Definition

In this section, enter the definition and identification data of the rule and source value; that is, the starting value for base composition.

Rule Code: In this field, enter the identifier code. This field is required and you can register no more than one rule with the same code, because this code is used for linking with the other entities.

Description: In this field, enter the rule description. Describe it as you wish, to make identifying the rule easier.

Source Value: In this field, select the starting value for composing the calculation base. The available options are:

- 01 - Value of Goods: The starting value for the base is the value of the goods.

- 02 - Quantity: The starting value for the base is the quantity.

- 03 - Accounting Value: The starting value is the accounting value, calculated in accordance with settings already found in the system.

- 04 - Value of Presumed Credit: The starting value is the calculated value of presumed credit. Important: This option uses only presumed credit calculated through generic configuration; that is, through fields <F4_TPCPRES> and <F4_CRDPRES>.

- 05 - ICMS Base: The starting value is the ICMS base, calculated in accordance with settings already found in the system.

- 06 - Original ICMS Base: The starting value is the original ICMS base; that is, the ICMS base calculated in accordance with settings already found in the system, without taking base reductions into account.

- 07 - ICMS Value: The starting value is the ICMS value, calculated in accordance with settings already found in the system.

- 09 - Shipping Value: The starting value for the base is the value of shipping.

- 09 - Trade Note Value: The starting value is the trade note value, calculated in accordance with settings already found in the system.

- 10 - Item Total Value: The starting value for the base is the total value of the item, calculated in accordance with settings already found in the system.

- 11 - Manual Formula: When you select this option, Protheus interprets the contents of tab Calculation Formula Details, enabling a customized calculation of the calculation base in accordance with customer needs. See section Calculation Formula Details of this manual for more explanations on how to use it.

All options refer to the respective calculated value in the document item.

Additions and Deductions

In this section, define the additions and subtractions to be applied on the source value selected in field Source Value.

Fields Discount, Shipping, Insurance, Expenses, ICMS Exemp. and ICMS Withheld have the same goal and define the action of each value, respectively.

The available options are:

1 - No Action: The value at issue does not affect the source value.

2 - Subtract: The value at issue is subtracted from the source value.

3 - Add: The value at issue is added to the source value.

Calculation Base Reduction

In this section, if applicable, enter whether a reduction will be applied to the calculated base.

Reduction %: In this field, enter the reduction percentage to be applied to the calculation base.

Reduction Type: This field defines the moment in which the reduction configured in field Reduction % should be applied. Before or after additions and deductions. The options are:

1 - Reduce before additions/deductions: The base reduction is applied before additions and deductions.

Example:

- Value of goods: 1000.00

- Shipping (Sum): 100.00

- Expenses (Sum): 50.00

- Reduction: 30%

1,000.00 * 70% = 700.00

= 700.00 + 150.00 = 850.00

= 850.00

2 - Reduce after additions/deductions: The base reduction is applied after additions and deductions.

Example:

- Value of goods: 1,000.00

- Shipping (Sum): 100.00

- Expenses (Sum): 50.00

- Reduction: 30%

1,000.00 + 100.00 + 50.00 = 1,150.00

= 1,150.00 * 70% = 805.00

= 805.00

Calculation Base by Quantity

In this section, available only when the source value is equal to 02 - Quantity, define whether to convert the quantity entered in the item to a specific measurement unit (only for purposes of defining the generic tax calculation basis).

Unit: In this field, enter the measurement unit to be used in the calculation base conversion.

The quantity is converted in accordance with the settings of fields already found in the product register; that is, the 1st and 2nd measurement units, the conversion factor and the conversion type, following these criteria:

If no specific measurement unit is defined, no conversion is made; therefore, the calculation base is exactly the quantity entered in the document item.

Example:

- 1st measurement unit of product: CX (Box)

- 2nd measurement unit of product: PC (Part)

- Conversion factor: 10.00

- Conversion type: M - Multiplier

- Quantity in document item: 3.00

- Unit entered in field Unit: None

Resulting calculation base: 3.00

If you define a specific measurement unit and it corresponds to the first product measurement unit, no conversion is made either; therefore, the calculation base is exactly the quantity entered in the document item.

Example:

- 1st measurement unit of product: CX (Box)

- 2nd measurement unit of product: PC (Part)

- Conversion factor: 10.00

- Conversion type: M - Multiplier

- Quantity in document item: 3.00

- Unit entered in field Unit: CX (Box)

Resulting calculation base: 3.00

If you define a specific measurement unit and it corresponds to the second product measurement unit, the quantity entered in the document item is converted in accordance with the conversion type and factor defined in the product at issue.

Example:

- 1st measurement unit of product: CX (Box)

- 2nd measurement unit of product: PC (Part)

- Conversion factor: 10.00

- Conversion type: M - Multiplier

- Quantity in document item: 3.00

- Unit entered in field Unit: PC (Part)

Resulting calculation base: 30.00

If you define a specific measurement unit and it corresponds neither to the first nor to the second product unit, then the calculation base cannot be defined; therefore, the tax at issue is not calculated.

Example:

- 1st measurement unit of product: CX (Box)

- 2nd measurement unit of product: PC (Part)

- Conversion factor: 10.00

- Conversion type: M - Multiplier

- Quantity in document item: 3.00

- Unit entered in field Unit: UN (Unit)

Resulting calculation base: 0.00.

Rate Rule Register

Use this routine to register rate rules for generic taxes. This rule is interpreted when bookkeeping the tax document and the value obtained through it is used as a generic tax rate.

In this register, fill in the following data:

Rate Definition

In this section, define the rule code, a description and the source value of the rate, in accordance with the fields below:

Rule Code = In this field, define the rule code. This field is required and you can define as you wish, though you cannot repeat it.

Description = In this field, enter the description of the rate rule. Describe it as you wish, to make identifying this tax easier.

Source Value = This field is required. Enter the source of the rate through the options below:

- 01 = ICMS Rate - The ICMS Rate specified in the tax document is used.

- 02 = Presumed Credit Rate - The rate of Presumed Credit specified in the tax document is used. The presumed credit used ins the generic one, defined through fields Pres Cred. (F4_CRDPRES) and Pres Cred Tp (F4_TPCPRES) of the TIO Register.

- 03 = ICMS ST Rate - The ICMS ST Rate specified in the tax document is used.

- 04 = Manually Entered Rate - Select this option to define a manual fixed rate. When you select this option, the Manually Entered Rate section is enabled, allowing the manual typing of the rate.

- 05 = Tax Reference Unit (URF) - Select this option to enable the Tax Reference Unit section, allowing the use of a previously registered URF.

- 06 = Manual Formula - When you select this option, Protheus interprets the contents of tab Calculation Formula Details, enabling a customized calculation of the rate in accordance with customer needs. See section Calculation Formula Details of this manual for more explanations on how to use it.

- 07 = Progressive Table - Select this option to use the progressive table rule for rate calculation.

Important

If the source value is not calculated in the tax document, the generic tax rate is zero; hence, the generic tax is also not calculated.

Manually Entered Rate

This section is only enabled when field Source Value is set to option 04. Here you can manually define the fixed rate through fields:

Rate Type = In this field, define the type of rate. Use option 1 - Percentage to define the rate as a percentage and option 2 - Measurement Unit to define the rate as a fixed value to be applied in the tax calculation.

Rate = In this field, enter the manual rate.

Tax Reference Unit

This section is only enabled when field Source Value is set to option 05. In this section, define the use of a URF as rate through fields:

URF Code = Enter the code of the previously registered URF.

URF Perc. = In this field, enter the URF percentage to be used. By default, this field is set to 100% URF utilization.

The URF value is obtained using the bookkeeping period of the invoice; hence, if there is no value for the invoice period when registering the URF, the rate is zero and, consequently, the tax is not calculated.

Bookkeeping Rule Register

This register aims to configure the tax bookkeeping. This rule register is similar to the TIO register, regarding Record and CST field configurations.

This rule is bound within Calculation Rule - Tax Documents in field "Bookkeeping" (F2B_CODESC).

In this register, fill in the following data:

Section Bookkeeping Rule Definition:

In this section, define the rule code and a description. The code is exclusive and cannot be changed or repeated.

Section Levy:

In this section, define who the tax is levied, including the tax classification, tax levy, reduced installment levy, effect on invoice total and the deferral percentage.

Section Tax Status Code:

In this section, define which CST to use for bookkeeping a tax configured in routine Calculation Rule - Tax Documents.

Important

The rules defined in this register are used for recording Table CJ3 – Bookkeeping by Item.

Calculation Rule Register - Tax Documents

This register aims to register the generic tax; that is, to define when and how to perform the calculations, using previously registered profiles and rules. This register also defines how to generate financial bills and whether the tax is used in the verification of generic taxes. Thus you can calculate, collect and verify new taxes in a simple and quick way, with no need to create new parameters or new system fields.

For example, suppose we previously register the tax XPTO, a tax for which the following hypotheses exist: Withholding by Tax Authorities, Credit and Collection on Verification. The need to create three calculation rules for this tax soon arises; that is, three tax calculation variations, one for withholding by tax authorities, another for credit and the third one for verification. Thus, you must create the calculation rules for each tax variation. Be mindful that the routine allows registering as many variations as needed.

Rule Definition

This section aims to identify the tax calculation rule using a code, description and validities.

Rule Code (F2B_REGRA): In this field, define the calculation rule code of generic tax. This code is required and cannot be repeated within the same validity. This code is displayed in the fiscal document taxes tab when the tax is calculated.

Description (F2B_DESC): This required field helps to identify the tax calculation rule. This description is displayed in the taxes tab when the tax is calculated.

Tax (F2B_TRIB): In this required field, enter the tax code to which this rule belongs. A tax may have several calculation rules; however, a calculation rule can have only one tax.

Start Date (F2B_VIGINI): Enter the start date of calculation rule validity; that is, if the tax document date is before the start date of validity, the tax rule is not calculated. If after or equal to it, then the calculation rule can be executed. This field is required.

End Date (F2B_VIGFIM): Enter the end date of tax rule validity. Of course, this is used only when the end date is known. When the end date of validity is not known, leave it blank.

When you fill in the initial and final validities, the system checks whether the document date is between the initial and final validities. When there is only the initial validity, the system checks the document date with the initial validity and regards the blank final validity as valid/in effect.

Calculation Rules

This section aims to define how to calculate the tax, how to generate the financial bills (if any) and how to generate it on verification (if any).

Calculation Base (F2B_DESC): Define the calculation base to calculate the tax through a previously registered Calculation Base rule. Be mindful that if the value set in the Calculation Base Rule is not found in the tax document, the generic tax is also not calculated.

Rate (F2B_RALIQ):Define the rate to calculate the tax through a previously registered rate rule. Be mindful that if the value set in the Rate Rule is not found in the tax document, the generic tax is also not calculated.

Financial (F2B_RFIN):In this field, enter a financial rule that defines how to generate the financial bill of this tax. Fill in this field only when you need to generate bills for withholding by tax authorities or collections on tax document issue, otherwise leave it blank. We must emphasize that if the tax must be collected through a verification, it is very likely that you should not fill in this field, otherwise the tax may be collected twice, in the tax document and also in the verification.

For further information on how to register the financial rule, refer to https://tdn.totvs.com/x/NBu9Gg

Round Config (F2B_RND):In this field, define the bill rounding rule, whether rounded or truncated. This field is not required. If blank, the calculated value is rounded by default. This field operates jointly with parameter MV_RNDSOBR. For further information on this parameter, refer to the documentation https://tdn.totvs.com/x/2Ni-HQ

Tax Limitation Rules

Min. Oper. of Tax Limitation (F2B_OPRMIN) - Limiting operator of Tax being configured. In this field, you may set limits by primary operator values.

Max. Oper. of Tax Limitation (F2B_OPRMIN) - Limiting operator of Tax being configured. In this field, you may set limits by primary operator values.

Min. Manual Value (F2B_VLRMIN) - This field is enabled along with field Minimum Operator, being editable when the value of field minimum operator is = "O:VAL_MANUAL"

Max. Manual Value (F2B_VLRMIN) - This field is enabled along with field Maximum Operator, being editable when the value of field maximum operator is = "O:VAL_MANUAL"

Bookkeeping Rules

Verification Rule (F2B_RAPUR): In this field, enter the verification rule to define how to state and calculate tax values in the generic taxes verification. This field is not required. Fill it in only when the tax must be collected through a verification. We must emphasize that if the tax has an entered financial rule, it is very likely that you should not fill in this field, otherwise the tax may be collected twice, in the tax document and also in the verification.

Bookkeeping (F2B_CODESC): In these fields, enter the bookkeeping rule that defines whether to book the tax as charged, exempt or others. Also the CST of the tax, among other settings allowed by the register.

Complementary Rules

Tax for Increase (F2B_TRBMAJ): In this field, select a tax to calculate the increase.

Deduction per Dependent (F2B_DEDDEP): Rule code that contains data on the calculation base deduction per dependent.

Progressive Table (F2B_DEDPRO): Rule code for progressive table deduction.

Form Gen. Rule (F2B_RGGUIA): Rule code for GNRE generation.

Auxiliary Calculation Base (F2B_RBASES): Rule code of secondary calculation base, for scenarios with base value calculation, when there is a need to calculate two calculation bases and use the one with the highest value.

Greater or smaller value between bases (F2B_MAXMIN): Select an auxiliary base in field F2B_RBASES to activate the field. Select 1=Higher - to load the higher value between the calculation base and the auxiliary calculation base. Select 2=Lower - to load the lower value between the calculation base and the auxiliary calculation base.

Profile Definition

This section aims to define when to calculate the tax, based on Origin/Destination, Participant, Operation and Product profiles.

The generic tax calculation rule is only executed when the invoice data (State of Origin, State of Destination, Participant, CFOP, Operation Type, Product and Product Origin) match all the profiles entered in this section.

Ori/Des Prof. (F2B_PEROD): In this field, define the Origin/Destination Profile for the calculation rule. Be mindful that the States of Origin and Destination of the tax document are compared with the States of Origin and Destination that compose this profile.

Part Prof. (F2B_PERFPA): In this field, define the Participant Profile for the calculation rule. Be mindful that the Participant (client or supplier) of the tax document is compared with the Customers and Suppliers that compose this profile.

Oper Prof. (F2B_PERFOP): In this field, define the Operation Profile for the calculation rule. Be mindful that the CFOP and Operation Type (if any) of the tax document are compared with the CFOPS and Operation Types that compose this profile.

Prod Prof. (F2B_PERFPR): In this field, define the Product Profile for the calculation rule. Be mindful that the Product and Product Origin of the tax document are compared with the Products and Product Origins that compose this profile.

Important

We must emphasize that, to perform the calculation, all four profiles must match the invoice data. Of the tax document only matches one, two or three profiles, the calculation does not occur.

Entry Adjustment Rule

Message Register

Use this routine to register messages. In this initial stage, this register services the messages used in EFD ICMS IPI in records 0460 (Tax Entry Notes Table), C195 (Tax Entry Notes (Codes 01, 1B, 04 and 55)) and C197 (Other tax obligations, adjustments and data on values from tax documents).

Example

In this register, fill in the following data:

Rule Code: Enter the Rule Code.

Description: Enter the name of the Message Rule

Filter Field:

In field CJ8_TPREGR (Rule Type), selecting Taxes enables, in field CJ8_TRIFIL (Rule to be queried), the 3 spheres (State, Federal and Local), and, by selecting one of the options for query, the field CJ8_REGTRA (Tax) is filtered by Rule Type;

CJ8_TRIFIL (Rule to be queried)

CJ8_REGTRA (Tax)

If Rule Type is equal to Generic Taxes, field CJ8_TBCONF (Generic Tax) is enabled with the query in table F2B (Tax Rules).

If, in field CJ8_TPREGR (Rule Type), you select Invoice Data, then, in field CJ8_TRIFIL (Rule to be queried) the options Invoice Header and Items' Data are enabled. By selecting one of the options, then the field CJ8_CONSUL (Value to be Added to Formula) displays information such as Invoice Type, Operation Type, Item Number, Value of Goods, etc.

After selecting the previous information, you may add the content selected in field CJ8_CONSUL (Value to be Added to the Formula) to field CJ8_MENSG (Message Composition), by clicking the Add button. After the addition, just click Validate Message.

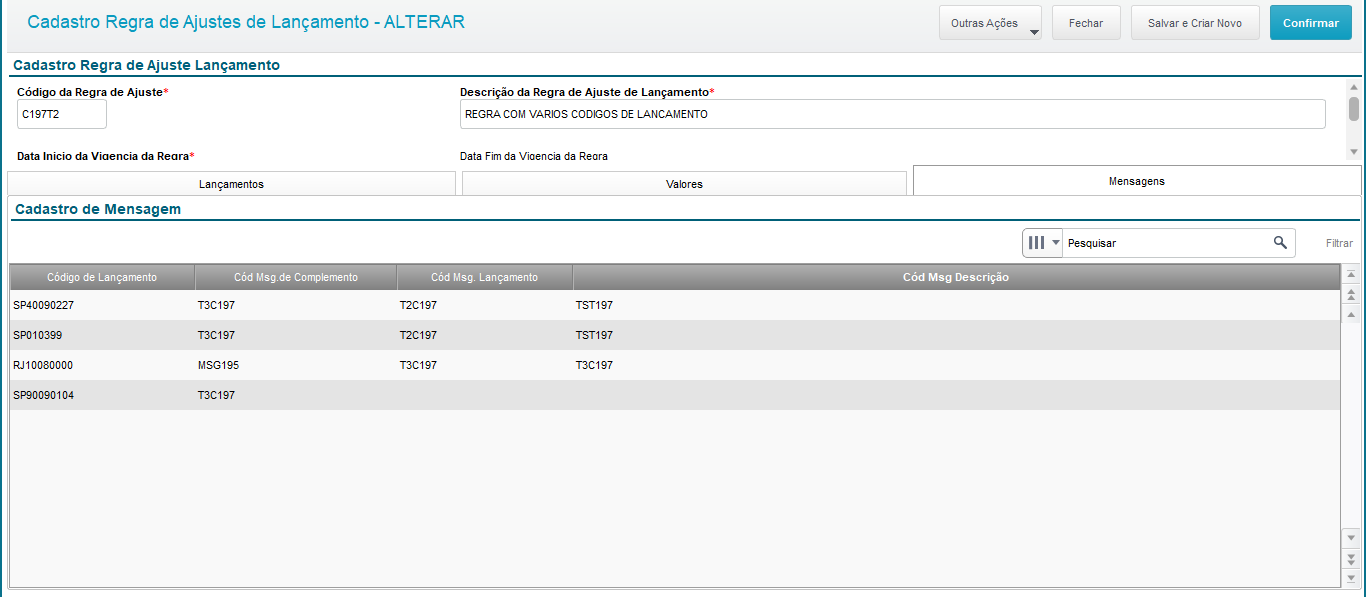

Entry Adjustment Rule

Use this routine to register the Entry Adjustment Codes, linking it to a Tax Document Rule to be created by the user, in accordance with its bookkeeping, hence stating the entry code data when the document is generated.

Thus, with this register we unify:

- Link of Entry Code registered in TIO.

- Link of Reflection Code for calculation rules, made in FISA072.

- Linking of messages on table CCE (Complementary Information) or in the TIO register (Table SF4), field F4_CODOBSE (Note Code)

- C197

- C195

- 0460

- Regarding the entry codes related to IPI, there will be a link with block E531 of EFD ICMS/IPI.

Access - Updates → Facilitators → Taxes Configurator

In this register, fill in the following data:

*Required Fields

**Fields not Viewable in Browser

Section Entry Adjustment Rule Register. Fill in with Rule header data, where we find the fields:

- CJ9_CODREG* - Rule Code

- CJ9_DESCR* - Adjustment Rule Description

- CJ9_VIGINI* - Start Date of Rule Validity

- CJ9_VIGFIM* - End Date of Rule Validity

- CJ9_ID** - Which is related to Table CJA - Entry Adjustment Rule Items.

Section Entries. Fill in the fields related to entry, validity and form codes.

- CJA_CODREG** - Header Rule Code - To be related to Table CJ9

- CJA_REGCAL* - Calculation Rule - We will have a standard query with Table F2B, in which the user selects the calculation rule that matches the Adjustment Code rule. In this field, instead of having a calculation in the reflection register, they would create their own calculation.

- CJA_CODTAB* - Entry Table - In this field, find available 4 entry tables 5.1.1 (CDO), 5.2 (CDY), 5.3(CC6) and 5.3.4(CCK)

- CJA_CODLAN* - Entry Code - The table selected in field CJA_CODLAN updates the standard query, returning the entry codes of each table.

- CJA_VIGINI* - Entry Validity Start Date - The user enters the start date of entry code validity found in the TXT files downloaded from the website http://sped.rfb.gov.br/

- CJA_VIGFIM* - Entry Validity End Date - The user enters the end date of entry code validity found in the TXT files downloaded from the website http://sped.rfb.gov.br/

- CJA_GUIA - Generate Form - In this field, select the code with the rule for generating the Tax Payment Form.

- CJA_TITULO - Generate Bill - In this field, select the code with the Bill rule, to be registered in routine Financial Rule.

- CJA_GERMSG - Message Type - This field controls how to generate the message for 01 - Entry Code, in which a message is generated for each entry code, or 02 - Entry Code + Product, if a single message is generated for Entry and Product.

- CJA_OPER - Operation - Enter the rule x entry code operation type to be used: 01 - Inflow; 02 - Outflow; 03 - Return;

- CJA_CNTRL - Operation State - Enter the State control of the Operation. This field functions jointly with the Entry Code. Example: SP000207 if you configure the State of Destination, to display the entry, your Customer must be from São Paulo; otherwise, if your Customer is from Rio de Janeiro and the entry is correct, just change the State from Control to Origin.

Section Values. Fill out the fields with values to inform EFD ICMS IPI records.

- CJA_NFBASE* - Use ICMS Base - This field offers 3 options - Value / Null / Zero, in case the calculation rule requires setting the ICMS Base to Zero, Value or NULL. If needed, record |BLANK| content in SPED.

- CJA_NFALIQ* - Use Rate - This field offers 3 options - Value / Null / Zero, in case the calculation rule requires setting the ICMS Rate to Zero, Value or NULL. If needed, record |BLANK| content in SPED.

- CJA_VALOR* - Use ICMS Value - Use this field to control how the rule interprets ICMS value contents when you need to generate field 7 of record C197, to be understood as Value. In this field, we have a standard query in CIN with Tax rule filter with field CJ9_REGCAL.

- CJA_VLOUTR* - Use Other ICMS Value - Use this field to control how the rule interprets ICMS value contents when you need to generate field 8 of record C197, to be understood as Other. In this field, we have a standard query in CIN with Tax rule filter with field CJ9_REGCAL.

Important

Field CJA_VLOUTR records in Table CDA in field CDA_VLOUTR. This field in CDA is exclusive in Tax Configurator.

This recording in CDA is automatically performed to configure how the Entry Adjustment Code understands the ICMS value to be transferred to Record C197, whether in field Value or field ICMS Other.

Be mindful that this process is fully independent from configurations performed in Legacy flow, using reflex register x field Vl REG 197 .

Description | CDA Recording | Source of the Information |

Msg Code Desc. Rec. 0460 | CDA_TXTDSC | CJA_TXTDSC |

Complementary Msg Code | CDA_CODCPL | CJA_CODCPL |

Entry Msg Code | CDA_CODMSG | CJA_CODMSG |

Use ICMS Value Other | CDA_VLOUTR | CJA_VLOUTR |

Calculation Rule | CDA_REGCAL | CJA_REGCAL |

Base Option | CDA_OPBASE | CJA_NFBASE |

Rate Option | CDA_OPALIQ | CJA_NFALIQ |

Group Entry Code | CDA_AGRLAN | CJA_GERMSG |

Section Messages. Enter the message data to be used in records 0460, C195 and C197.

- CJA_CODMSG - Message Code - In this field, select the message pre-registered in routine FISA178 - Message Register to be used in EFD ICMS IPI Record C197 field 3.

- CJA_CODCPL - Complement Text - In this field, select the message pre-registered in routine FISA178 - Message Register to be used in EFD ICMS IPI Record C195 field 2 and field 3.

- CJA_TXTDSC - Description Text - In this field, select the message pre-registered in routine FISA178 - Message Register to be used in EFD ICMS IPI Record C195 field 2 and field 3.

Adjustment Rule Code Utilization Example

Follow the steps below to configure how to use the Adjustment Rule register

- Make the Registrations

- Register the Tax

b. Register the NCM Rules

c. Register the Tax Status Code

2. Make the Profile Registrations

- Product Profile

- Operation Profile

- Participant Profile

- Origin and Destination Profile

- Product Profile

3. Tax Document Calculation Rules

Calculation Base Rule

ICMS Base Example

ICMS Base Exempted via Formula Example.

iii. IPI Base Example

b. Rate Rule

c. Bookkeeping Rule

d. Calculation Rule - Tax Documents

In this register, we link the above relationship registers to be used in invoice calculations.

- ICMS Rule

- FECP Calculation Rule

- Exempted ICMS Calculation Rule

- IPI Calculation Rule

- ICMS Rule

4. Entry Adjustment Rule

- Message Rule

Message with Specific Formula:

It is not enough to create the message. The next step is binding the message registered to an entry adjustment rule. - Entry Adjustment Rule

- Message Rule

i. ICMS Example - Entries Tab

The proposal of the register is to centralize the entry codes in the widest adjustment rule possible, so there is no need to create multiple entry adjustment rule registers for similar profiles; therefore, for release 12.1.2210, we have added two fields not illustrated in the example above, in which the user can choose when to use the entry code:

Field Operation - Valid Values (01-Inflow| 02-Outflow| 03-Return)

Field Operation Type - Valid Values (01-Origin State| 02-Destination State)

In the illustration above, we can see that several entry codes have been attributed even from another state, the branch of the example being SP.

Through fields Operation and Operation Type, the user can define when to use the entry code. In the example, an entry code was registered for the State of Rio de Janeiro, in which the fields Operation and Operation Type are respectively configured as "Outflow"|"State of Destination"; that is, the entry code is only displayed when an outgoing invoice is issued with RJ as its State of Destination.

In tab Entries, we also have the field "Message Type" with 3 possible options:

01- Entry Code by Period - In this configuration for EFD ICMS/IPI file creation purposes, the entry codes are grouped by period in accordance with the block in which a specific entry code fits the SPED.

02- Entry Code by Invoice - In this configuration for EFD ICMS/IPI file creation purposes, the entry codes are grouped by invoice in accordance with the block in which a specific entry code fits the SPED. Example: Block C195 and C197.

03- Entry Code by Item - In this configuration, for EFD ICMS/IPI file creation purposes, the entry codes do not have grouping; that is, they are detailed by item, as the record was originally recorded in CDA table.

ii. Tab Values

In tab Values, define how values are displayed in accordance with the entry code. This tab is very useful for the composition of block C197 and similar blocks in SPED FISCAL.

Example of Entry Configuration highlighting the value Other.

iii. Tab Messages

Use this tab to bind the messages registered in routine FISA178 (Message Register). In the example below, the fields are used in various ways:

Note: Fill out the field "Complement Msg Code" to correctly display it in SPED FISCAL.

iv. IPI Example

The IPI dynamic is similar to ICMS.

5. Applying the Invoice Entry Adjustment Rule

Rule TRIB03, created with Exempted ICMS, was used in the Entry Adjustment register and will be stated in TAB Entry of the Financial Spreadsheet. This rule aims to calculate the values needed for display in the Entries indicated.

- Rule IPI001 was created for generating "Other Credits" adjustment entry for IPI verification and also for its reflex in block E531 of EFD ICMS/IPI.

In the IPI verification, the IPI adjustment values from the tax configurator remain separate from values that come through TIO adjustment entries. The example below shows how the verification becomes with both entry types:

Manual entries keep the current behavior.

Important

The Tax Rule Code entered in the Entry Adjustment register in field CJA_REGCAL must be a rule created by the customer, as needed and as the entry is understood.

Verifications Folder

Verification Bill Rule Register

This register aims to define how to generate financial bills of generic tax verification, linking a financial bill rule to a tax through fields:

Tax: In this field, we define the tax to be processed in generic tax verification, which will need to generate a financial bill with the debit balance of the verification.

Bill Rule: In this field, enter the bill rule to be executed in verification, when generating the financial bill. For further information on how to register a financial rule, refer to https://tdn.totvs.com/x/NBu9Gg

Verification Rule Register

This register aims to define how to state and calculate generic tax values in generic tax verification, enabling the composition settings of verification reversals, credit and debit values.

This register has an automatic load of rule suggestions that facilitate its use.

Rule Definition

In this section, enter a code and description to identify the verification rule.

Code = Code of verification rule, which is required and not to be repeated.

Description = Description to help identify the verification rule.

Transaction Rules

Section that defines how to process the tax values of incoming, outgoing and return invoices:

Outgoing: Enter how to state the generic tax values of outgoing invoices in the verification, through the options:

1 - No Action = Taxes calculated in outflows are not stated in the verification.

2 - Debit = Taxes calculated in outflows are stated as debit in the verification.

3 - Credit = Taxes calculated in outflows are stated as credit in the verification.

Incoming: Enter how to state the generic tax values of incoming invoices in the verification of generic taxes, through the options:

1 - No Action = Taxes calculated in inflows are not stated in the verification

2 - Debit = Taxes calculated in inflows are stated as debit in the verification.

3 - Credit = Taxes calculated in inflows are stated as credit in the verification.

Returns: Enter how to state the values of sales and purchase returns in the verification, through the options:

1 - No Action = Returns have no reversal action in the verification

2 - Counterpart = Returns generate debit reversals if the original invoice has generated debit, and generate credit reversals if the original invoice has generated credit.

Generic Taxes Verification

Use this routine to verify generic taxes. Its purpose is to totalize the credits and debits generated in each operation, in accordance with the configured verification rules, thus calculating a credit or debit balance of the respective tax. In the hypothesis of a debit balance, the routine enables the generation of a bill payable and, in the hypothesis of a credit balance, a balance control is carried over and used in later periods to deduct the debit values.

The information used in the verification is from the tables below:

SD1 - Incoming Invoice Items;

SD2 - Outgoing Invoice Items;

SF1 - Incoming Invoice Headers;

SF2 - Outgoing Invoice Headers;

SFT - Tax Records by Invoice Item;

F2D - Calculated Generic Taxes;

Verification Processing

Process: Start a new verification.

Edit: To edit an already existing verification, if the bill is not yet generated.

View: Viewing of an already existing verification.

Other Actions:

Delete: Delete the verification selected. If an already generated bill has been posted, the deletion is not allowed. The following message is displayed: “The bill <bill number / prefix> is already posted and cannot be deleted”. In this case, you need to manually reverse the bill at issue through financials before deleting the verification.

Generate Financial Bill: Generate the bill of the verification selected, if there is a debit balance. The bill is generated based on the financial rule linked to the tax verified through routine "Verification Bill Rule". This financial rule defines all aspects of the bill, such as supplier, nature, due date, prefix, etc. Thus, if no rule has been linked to the tax verified, you cannot generate the verification bill and the following error message is displayed: "Tax lacks rule of Bill x Verification."

Generate Financial Bill/Booking: Generate the bill of the verification selected, if there is a debit balance, following the same rule of button "Generate Financial Bill". After generating the bill, bookkeeping is activated and the bill is booked. The LPs used in this process are: 767 for addition and 768 for deletion/reversal.

Book Generated Bill: Book the previously generated bill for the verification selected. The LPs used in this process are also 767 for addition and 768 for deletion/reversal.

View Generated Bill: View the previously generated bill for the verification selected.

Verification Checking Report: Generates the detailing/checking report of the verification selected.

Click Process to start a new process and request a branch. For taxes that must be verified in a centralized way, the branch selected must be the centralizing branch; that is, the branch under which the transactions are consolidated.

This selection simulates the login at the branch selected; that is, you can verify a tax in a non-centralized way, branch to branch, without having to actually log onto each branch. Just select them, one by one, and follow the process as usual.

After selecting the verification branch, the parameter settings screen is displayed:

Start Date: Start Date of verification period.

End Date: End Date of verification period.

Select Branches: Enter whether to display the screen for branch selection, if you must use transactions from branches other than the previously selected verification branch. If this field is set to "2-No", only transactions from the verification branch are used.

Taxes: This list displays taxes liable to verification for selection. Select at least one tax to continue the process. You can also select more than one tax. In this case, a separate verification is performed for each tax.

A tax liable to verification is a tax that has, in at least one of its variations, an associated verification rule.

Click Next to perform the verification, displaying the verification screen:

This tab presents verified values such as debit, totalized by calculation rule; that is, for each tax variation being verified. Column Returns (Debit Reversal) states the values of each return that voids the debit; that is, the debit reversals.

This tab presents verified values such as credit, totalized by calculation rule; that is, for each tax variation being verified. Column Returns (Credit Reversal) states the values of each return that voids the credit; that is, the credit reversals.

This tab states a summary of the verification. Totalizers of debits, credits, adjustments, credit balances from previous periods that may have been used in the verification, debit balance, etc.

Verification Adjustments

You can add and delete manual adjustments to handle the values verified. Double click the line Debit Adjustments or Credit Adjustments to list adjustments in accordance with type. You can use this list to add new adjustments, as well as to edit or delete existing adjustments. You can also access the adjustments list through menu Other Actions.

All adjustments entered are regarded as addition adjustments; that is, with the purpose of increasing credit or debit depending on adjustment type. Reduction adjustments are not available. To reduce debits or credits, add an addition adjustment of the opposite type; that is, enter a credit adjustment to reduce debits and a debit adjustment to reduce credits.

To add, edit and delete adjustments, the verification must be in edit mode. In viewing mode, you can only view previously registered adjustments.

Credit Balances

After each verification, if debits have not surpassed credits, a credit balance is generated and this balance is carried forward to the next period for later use. Double click any of the credit balance lines (carried over, used or to be carried over) to list the balances used in the verification at issue, with their respective periods of origin, and also how much of each balance was used in the verification. Balances are consumed in order of generation; that is, from older to newer.

Reports Folder

Report of Generic Taxes per Tax Document

To support the checking of generic tax calculations, we offer the report of generic taxes per tax document, so you can check tax values per tax document item, regardless of whether the tax generated withholding, payment or verification.

To process the report, just fill in the initial questions:

Start Date: Enter the start date to process the report.

End Date: Enter the end date to process the report.

Select Branches: This asks which branches to use for processing the report. Option 1-Yes opens a screen for selecting one or more branches, whereas option 2-No uses only the logged branch.

Tax: In this field, enter the tax to be processed in the report. You can only process one tax per report.

Once you confirm the report's processing, the invoices that have generic taxes calculated in the specified period and branch(es) are listed, considering invoices from tax records (tables SFT/SF3). After the report is finished, the data on the following structure:

Report Header Section:

Branch = Here the branch of the invoice is stated

Invoice Operation = This field identifies the invoice operation in the following hypotheses:

- Regular Inflow

- Regular Outflow

- Service Received

- Service Rendered

- Sales Return

- Purchase Return

- Invoice in Batch

- Processing

- IPI Complement

- ICMS Complement

- Complement

Tax Rule = This field states the tax rule code.

Rule Description = This field displays the rule description of the tax calculation.

Report Detail Section:

The section is composed of the following columns:

Invoice Number = Number of tax document.

Invoice Series = Series of tax document.

Participant Code = Code of customer/supplier.

Participant Store = Store of customer/supplier.

Date = Date of issue.

Invoice Item = Number of item.

CFOP = CFOP of item.

Measurement Unit = Measurement unit of item.

Calculation Base - Quantity = Calculation base in quantity of generic tax.

Tax Calculation Base = Calculation base of tax.

Tax Rate = Rate of generic tax.

Tax Value = Calculated value of generic tax.

Bookkeeping Checking Report

To help checking the bookkeeping of generic taxes, we offer the report of bookkeeping checking per tax document (detailed or summary), so you can check the tax values by item or grouped by tax document for the taxes carried.

To process the report, just fill in the initial questions:

Start Date: Enter the start date to process the report.

End Date: Enter the end date to process the report.

Select Branches: This asks which branches to use for processing the report. Option 1-Yes opens a screen for selecting one or more branches, whereas option 2-No uses only the logged branch.

Tax: In this field, enter the tax to be processed in the report. You can only process one tax per report.

Option: Enter the option of the report, whether 1-Detailed or 2-Summary.

Once you confirm the report's processing, the invoices that have generic taxes calculated in the specified period and branch(es) are listed, considering invoices from tax records (tables SFT/SF3) and the bookkeeping table of the tax configurator (CJ3).

After the report is finished, the data on the following structure for 1-Detailed:

After the report is finished, the data on the following structure for 2-Summary:

Verification Checking Report

This report supports checking the values displayed on the generic tax verification. To print the report, just select the verification processed, access Other Actions of the verification and select the option Verification Checking Report. The system automatically prints the report.

The report has 5 sections:

Debits

Credits

Adjustments

Credit Balance

Verification Summary

Debits Section

Section Debits states the original invoice values that generated debit in the verification, as well as the return values. This section is detailed by tax calculation rule.

Credits Section

The Credits section has the same principle as the Debits section; however, it states the values of Credits and their returns.

Adjustments Section

The Adjustments section states occasional manual adjustments of debit and credit done in the generic taxes verification.

Examples of Debit and Credit adjustments, respectively:

Balances Section

The balances section states the value details that compose the credit balance, displaying the start date of the balance, the initial value of the balance in the period, the value used in the period and the final balance of the period.

Summary Section

The summary section of the verification states the verification totals:

- Debits by Outflow

- Credit Reversals

- Debit Adjustments

- Debit Totals

- Credit Balance Carried Over from the Previous Period

- Credit Balance of the Previous Period Used

- Credits by Inflow

- Debit Reversals

- Credit Adjustments

- Credits Total

- Debit Balance

- Credit Balance to Carry Over to Next Period

Facilitators

Profile Register Facilitator

To support the creation and maintenance of profiles, we offer facilitators in menu Other Actions -> Facilitator, found in the register of each profile. You can use these facilitators to add or delete batches, with no need to do it item by item.

The facilitator enables the assembly of filters in the source table, then the addition or deletion of filter results all at once in the profile(s) selected.

For Participant and Product Tax Profiles, when the key word ALL is used, encompassing all products, customers or suppliers. You cannot perform maintenance on these records individually, given that the existing registers lack a physical link to each product, customer or supplier.

Selection of Operation

On this stage, select the operation to be executed: Addition or Deletion:

Selection of Profiles

On this stage, select the profile (or profiles) in which the addition or deletion will be performed:

Filters

On this stage, create the filter to be applied to the respective table, for selecting the records to be added or deleted from the profile(s) selected:

Selection of Records

On this stage, list the records that result from the filter applied. Select the records that must actually be added or deleted:

Summary

In this last stage, check/confirm the operations to be executed:

Click Confirm to execute the operations and change the profiles selected.

Facilitator of Supplier, Customer and Product Registration

Besides the facilitator found in the profile register itself, there are also two other ways to link products, customers and suppliers to one or more profiles.

To use this feature:

- Access the register at issue.

2. Select a record.

3. Click "Edit" or "View"

4. Access the menu "Other Actions -> Tax Profiles"

The profiles to which the record at issue is linked are listed:

Through buttons "Link to Other Profile(s)" AND "Unlink from the Profile Selected", you can link the record to one or more profiles and also unlink it when needed.

Addition Facilitator - Supplier, Customer and Product

Beside the two aforementioned methods, you can also link a record to one or more profiles when adding the record. After you have effectively added the record, the system validates whether one or more tax profiles have been added. If any, the following message is displayed:

Click Yes to list the profiles registered. At this point you can already link the record to one or to several profiles:

Dica

This feature is controlled by parameter MV_FACAUTO (Default = .F.). If the parameter is set to .F., then the message is not displayed and you must link the record to the profiles using any of the other methods mentioned, if needed.

History of Changes

If the customer needs the history of changes for some configurator routines, they can find a feature that will help them with this information in Other Actions > History of Changes.

Routines that have this feature:

- Dependents Register (FISA160C)

- Calculation Base Rule (FISA161)

- Rate Rule (FISA162)

- Bookkeeping Rule (FISA160J)

- Calculation Rule - Tax Documents (FISA160)

Calculation Formula Details

In the registers of Calculation Base Rule (FISA161), Rate Rule (FISA162) and Calculation Rule - Tax Documents (FISA160), we offer a new tab with the calculation formula that Protheus will interpret.

In this new tab, just click the Edit Formula button to edit the formula, activating the following field:

The next step is to select the rule type to be queried:

- 1 - Origin Values

- 2 - Calculation Base Rule

- 3 - Rate Rule

- 4 - URF Rule

- 5 - Tax Rule

- 6 - Calculation Indexes

- ZZ - Manual Value

Origin Values

The system creates them automatically.

Protheus already knows the Origin Value, having already calculated it on formula execution. This value can be the Value of Goods, Quantity, Accounting Value, Zero value of Calculation Base or Rate, etc.

Example:

Problem - Configure a rate with value zero

I will create a new Rate Rule and set the Origin Value = 06 - Manual Formula, taking the following step in the formula:

- Field Rate Rule to be queried = 01 - Origin Values

- Field Rule Query = O:ZERO

- Click Add

Calculation Base Rule

Select this option to enable the field Rule Query and select a Calculation Base Rule from the system. Thus, you can add another procedure to the formula, for the calculation base rule set in the system in any register with the Calculation Formula Details tab.

Example:

Problem - I need my calculation base to be the Value of Goods + BRL 100.00

In the system, I already have the Calculation Base Rule RB0001 selected in field Origin Value = 01- Value of Goods.

I will create a new Base Rule and set the Origin Value = 11 - Manual Formula, taking the following step in the formula:

- Field Rate Rule to be queried = 02 - Calculation Base Rule.

- Field Rule Query = RB0001

- Click Add

- Click +

- Field Rule Type to be queried = ZZ - Manual Value

- Field Value to be added to formula = 100

- Click Add

Rate Rule

Select this option to enable the field Rule Query and select a Rate Rule from the system. Thus, you can add another procedure to the formula, for the rate rule set in the system in any register with the Calculation Formula Details tab.

It is used the same way as the Calculation Base Rule.

URF (Tax Reference Unit) Rule

Select this option to enable the field Rule Query and select a Tax Reference Unit from the system. Thus, you can add the URF procedure to the formula in any register, or even to the rate, without selecting the Origin Value - 05 - Tax Reference Unit (URF).

Select the URF register and choose the operation, whether to add, subtract, multiply or divide the value. Click the operator button, then add the value. If you want to leave only the fixed value in the formula, click Clear and add the value.

Tax Rule

Use this binding to use a property from a tax in another tax.

Select this option to enable the field Tax to filter the query and the field Rule Query.

Field Tax to filter the query displays the taxes registered in the system. This field is useful for filtering the query of field Rule Query.

Field Rule Query displays some tax variations, such as:

- ISE:TRIBO

- OUT:TRIBUTO

- BAS:TRIBUTO

- ALQ:TRIBUTO

- VAL:TRIBUTO

Calculation Indexes

The system creates them automatically.

We have created the calculation index for operations that require a specific procedure, so Protheus can manage to identify that the formula may contain a service rate, a deduction for dependents, an NCM (Tax Reference Unit) rule (MVA, Base Value, Increase) previously registered in the earlier stages of the tax configurator.

Example:

Problem - Configure a service rate for my generic tax

I will create a new Rate Rule and set the Origin Value = 06 - Manual Formula, taking the following step in the formula:

- Field Rate Rule to be queried = 06 - Calculation Index

- Field Rule Query = I:ALQ_SERVICO

- Click Add

Manual Value

Select this option to enable the field Value to be added to formula, so you can add a fixed value for the calculation base rule, rate or even for the Calculation Rule of the tax.

Enter the value desired and choose the operation, whether to add, subtract, multiply or divide the value. Click the operator button, then add the value. If you want to leave only the fixed value in the formula, click Clear and add the value.

ICMS verification x Entry Adjustment Rule

In this session, we show what the ICMS verification looks like when there are legacy entry codes (TIO) x Tax Configurator.

Example of an incoming invoice:

Example of an outgoing invoice:

Screen with verification of Local ICMS:

The system begins to perceive whether the entry originates in the configurator.

Given the same entry code and legacy as well as tax configurator both use them, the behavior is the same:

See code "SP100090748"

This behavior expands other verification tabs.

ICMS-ST

DIFAL

Special Debits

Extra Credit - Verification

In every scenario above, we had to create an entry adjustment rule in the tax configurator. Access the documentation folder "Tax Configuration Calculation" for details.

Messages Entry Adjustment Rule X EFD ICMS/IPI

This section shows how the SPED file relates to the messages registered in routine Entry Adjustment Rule of the tax configurator.

In the illustration below, the binding of messages to an adjustment rule is executed.

When you generate invoice Inflow or Outflow transactions, the system stores the records to table CDA and the decoded messages in table CJL, in which they are bound to an ID.

Note: The section below is technical and diverges from user experience, though it is necessary for comprehension of routine flow.

Table CDA - Adjustment Code Entries:

Table CJL - Decoded Message Control:

To put it simply, I took only one of the IDs related to code SP40090227 of item 1 or the invoice.

Note: Field CJL_INDICE determines to which block the message must be directed.

After processing the monthly verifications, find below an example of how the EFD ICMS/IPI file looks:

Legacy Taxes used by the Tax Configurator

You can also use the tax configurator to configure and manage some taxes calculated with legacy settings (product register, tax exception, StateXState, TIO register, etc.).

See below a list of the taxes currently calculated by the system, which are available in the configurator:

Tax | Description |

AFRMM | Additional Freight for Merchant Marine Modernization |

FABOV | Beef Cattle Breeding Support Fund |

FACS | Soybean Cultivation Support Fund |

FAMAD | Timber Support Fund |

FASE/MT | Mato-Grossense Seed Cultivation Support Fund |

FETHAB | State Fund for Transport and Housing |

FUNDERSUL | Development Fund for the Road System of the State of Mato Grosso do Sul |

FUNDESA | Animal Health Protection Development Fund |

IMA/MT | Mato-Grossense Cotton Institute |

SEST/SENAT | Transport Social Service/Transport Learning National Service |

TPDP | Public Spending Processing Fee for the State of Paraiba |

SENAR | Rural Learning National Service |

PIS | Social Integration Program |

COF | Contribution to the Financing of the Social Security |

II | Import Tax |

IRF | Withheld Income Tax |

INSS | National Institute of Social Security |

ISS | Service Tax |

ICMS | Tax on Circulation of Goods and Services |

IPI | Tax on Industrialized Products |

CIDE | Contribution for Intervention in the Economic Domain |

CPRB | Social Security Contribution on Gross Revenue |

FEEF | Fiscal Balance State Fund |

CSL | Social Contribution on Net Profit |

PROTEG | Social Protection Fund of the State of Goias |

FUMIPQ | Municipal Stimulus Fund for Micro and Small Businesses |

CRDPRE | Presumed Credit for ICMS |

CRPRST | Presumed Credit on Rendering of Transport Services with ICMS/ST |

CPPROD | PRODEPE - State of Pernambuco Development Program |

CRDPCT | Presumed Credit by Tax Load |

SECP15 | Special Retirement 15 years |

SECP20 | Special Retirement 20 years |

SECP25 | Special Retirement 25 years |

INSSPT | Employer INSS |

DIFAL | Rate Differential |

CMP | Complementary ICMS |

ANTEC | ICMS Advance |

FECPIC | FECP ICMS |