Histórico da Página

...

Procedure for Utilization

Credit Reversal - With Product Resale

Requirements

- Environment updated to release 12.1.22.10 or above;

...

Section Entry Adjustment Rule Register. Fill in with Rule header data, where we find the fields:

- CJ9_CODREG* - Rule Code

- CJ9_DESCR* - Adjustment Rule Description

- CJ9_VIGINI* - Start Date of Rule Validity

- CJ9_VIGFIM* - End Date of Rule Validity

- CJ9_ID** - Which is related to Table CJA - Entry Adjustment Rule Items.

Section Entries. Fill in the fields related to entry, validity and form codes.

- CJA_CODREG** - Header Rule Code - To be related to Table CJ9

- CJA_REGCAL* - Calculation Rule - We will have a standard query with Table F2B, in which the user selects the calculation rule that matches the Adjustment Code rule. In this field, instead of having a calculation in the reflection register, they would create their own calculation.

- CJA_CODTAB* - Entry Table - In this field, find available 4 entry tables 5.1.1 (CDO), 5.2 (CDY), 5.3(CC6) and 5.3.4(CCK)

- CJA_CODLAN* - Entry Code - The table selected in field CJA_CODLAN CODLAN updates the standard query, returning the entry codes of each table.

- CJA_VIGINI* - Entry Validity Start Date - The user enters the start date of entry code validity found in the TXT files downloaded from the website http://sped.rfb.gov.br/

- CJA_VIGFIM* - Entry Validity End Date - The user enters the end date of entry code validity found in the TXT files downloaded from the website http://sped.rfb.gov.br/

- CJA_GUIA - Generate Form - In this field, select the code with the rule for generating the Tax Payment Form.

- CJA_TITULO - Generate Bill - In this field, select the code with the Bill rule, to be registered in routine Financial Rule.

- CJA_GERMSG - Message Type - This field controls how to generate the message for 01 - Entry Code, in which a message is generated for each entry code, or 02 - Entry Code + Product, if a single message is generated for Entry and Product.

- CJA_OPER - Operation - Enter the rule x entry code operation type to be used: 01 - Inflow; 02 - Outflow; 03 - Return;

- CJA_CNTRL - Operation State - Enter the State control of the Operation. This field functions jointly with the Entry Code. Example: SP000207 if you configure the State of Destination, to display the entry, your Customer must be from São Paulo; otherwise, if your Customer is from Rio de Janeiro and the entry is correct, just change the State from Control to Origin.

Section Values. Fill out the fields with values to inform EFD ICMS IPI records.

- CJA_NFBASE* - Use ICMS Base - This field offers 3 options - Value / Null / Zero, in case the calculation rule requires setting the ICMS Base to Zero, Value or NULL. If needed, record |BLANK| content in SPED.

- CJA_NFALIQ* - Use Rate - This field offers 3 options - Value / Null / Zero, in case the calculation rule requires setting the ICMS Rate to Zero, Value or NULL. If needed, record |BLANK| content in SPED.

- CJA_VALOR* - Use ICMS Value - Use this field to control how the rule interprets ICMS value contents when you need to generate field 7 of record C197, to be understood as Value. In this field, we have a standard query in CIN with Tax rule filter with field CJ9_REGCAL.

- CJA_VLOUTR* - Use Other ICMS Value - Use this field to control how the rule interprets ICMS value contents when you need to generate field 8 of record C197, to be understood as Other. In this field, we have a standard query in CIN with Tax rule filter with field CJ9_REGCAL.

| Aviso | ||

|---|---|---|

| ||

Field CJA_VLOUTR records in Table CDA in field CDA_VLOUTR. This field in CDA is exclusive in Tax Configurator. This recording in CDA is automatically performed to configure how the Entry Adjustment Code understands the ICMS value to be transferred to Record C197, whether in field Value or field ICMS Other. Be mindful that this process is fully independent from configurations performed in Legacy flow, using reflex register x field Vl REG 197 . |

Description | CDA Recording | Source of the Information |

Msg Code Desc. Rec. 0460 | CDA_TXTDSC | CJA_TXTDSC |

Complementary Msg Code | CDA_CODCPL | CJA_CODCPL |

Entry Msg Code | CDA_CODMSG | CJA_CODMSG |

Use ICMS Value Other | CDA_VLOUTR | CJA_VLOUTR |

Calculation Rule | CDA_REGCAL | CJA_REGCAL |

Base Option | CDA_OPBASE | CJA_NFBASE |

Rate Option | CDA_OPALIQ | CJA_NFALIQ |

Group Entry Code | CDA_AGRLAN | CJA_GERMSG |

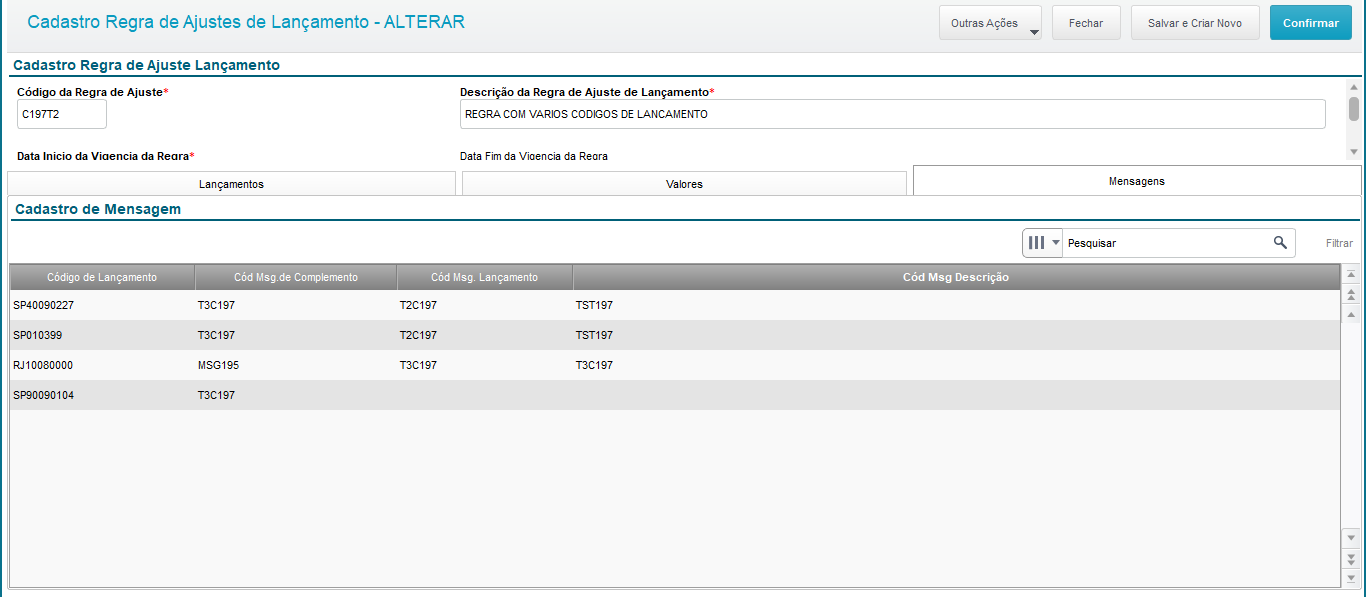

Section Messages. Enter the message data to be used in records 0460, C195 and C197.

- CJA_CODMSG - Message Code - In this field, select the message pre-registered in routine FISA178 - Message Register to be used in EFD ICMS IPI Record C197 field 3.

- CJA_CODCPL - Complement Text - In this field, select the message pre-registered in routine FISA178 - Message Register to be used in EFD ICMS IPI Record C195 field 2 and field 3.

- CJA_TXTDSC - Description Text - In this field, select the message pre-registered in routine FISA178 - Message Register to be used in EFD ICMS IPI Record C195 field 2 and field 3.

Adjustment Rule Code Utilization Example

Follow the steps below to configure how to use the Adjustment Rule register

- Make the Registrations

- Register the Tax

b. Register the NCM Rules

c. Register the Tax Status Code

...

2. Make the Profile Registrations

- Product Profile

- Operation Profile

- Participant Profile

- Origin and Destination Profile

Tax - Product Profile

3. Tax Document Calculation Rules

Calculation Base Rule

ICMS Base Example

ICMS Base Exempted via Formula Example.

iii. IPI Base Example

b. Rate Rule

c. Bookkeeping Rule

d. Calculation Rule - Tax Documents

In this register, we link the above relationship registers to be used in invoice calculations.

- ICMS Rule

- FECP Calculation Rule

- Exempted ICMS Calculation Rule

- IPI Calculation Rule

- ICMS Rule

Entry

4. Entry Adjustment Rule

- Message Rule

Message with Specific Formula:

It is not enough to create the message. The next step is binding the message registered to an entry adjustment rule. - Entry Adjustment Rule

- Message Rule

i. ICMS Example - Entries Tab

The proposal of the register is to centralize the entry codes in the widest adjustment rule possible, so there is no need to create multiple entry adjustment rule registers for similar profiles; therefore, for release 12.1.2210, we have added two fields not illustrated in the example above, in which the user can choose when to use the entry code:

Field Operation - Valid Values (01-Inflow| 02-Outflow| 03-Return)

Field Operation Type - Valid Values (01-Origin State| 02-Destination State)

In the illustration above, we can see that several entry codes have been attributed even from another state, the branch of the example being SP.

Through fields Operation and Operation Type, the user can define when to use the entry code. In the example, an entry code was registered for the State of Rio de Janeiro, in which the fields Operation and Operation Type are respectively configured as "Outflow"|"State of Destination"; that is, the entry code is only displayed when an outgoing invoice is issued with RJ as its State of Destination.

In tab Entries, we also have the field "Message Type" with 3 possible options:

01- Entry Code by Period - In this configuration for EFD ICMS/IPI file creation purposes, the entry codes are grouped by period in accordance with the block in which a specific entry code fits the SPED.

02- Entry Code by Invoice - In this configuration for EFD ICMS/IPI file creation purposes, the entry codes are grouped by invoice in accordance with the block in which a specific entry code fits the SPED. Example: Block C195 and C197.

03- Entry Code by Item - In this configuration, for EFD ICMS/IPI file creation purposes, the entry codes do not have grouping; that is, they are detailed by item, as the record was originally recorded in CDA table.

ii. Tab Values

In tab Values, define how values are displayed in accordance with the entry code. This tab is very useful for the composition of block C197 and similar blocks in SPED FISCAL.

Example of Entry Configuration highlighting the value Other.

iii. Tab Messages

Use this tab to bind the messages registered in routine FISA178 (Message Register). In the example below, the fields are used in various ways:

Note: Fill out the field "Complement Msg Code" to correctly display it in SPED FISCAL.

iv. IPI Example

The IPI dynamic is similar to ICMS.

5. Applying the Invoice Entry Adjustment Rule

Rule TRIB03, created with Exempted ICMS, was used in the Entry Adjustment register and will be stated in TAB Entry of the Financial Spreadsheet. This rule aims to calculate the values needed for display in the Entries indicated.

- Rule IPI001 was created for generating "Other Credits" adjustment entry for IPI verification and also for its reflex in block E531 of EFD ICMS/IPI.

In the IPI verification, the IPI adjustment values from the tax configurator remain separate from values that come through TIO adjustment entries. The example below shows how the verification becomes with both entry types:

Manual entries keep the current behavior.

| Aviso | ||

|---|---|---|

| ||

The Tax Rule Code entered in the Entry Adjustment register in field CJA_REGCAL must be a rule created by the customer, as needed and as the entry is understood. |

...

This register aims to define how to generate financial bills of generic tax verification, linking a financial bill rule to a tax through fields:

Tax: In this field, we define the tax to be processed in generic tax verification, which will need to generate a financial bill with the debit balance of the verification.

Bill Rule: In this field, enter the bill rule to be executed in verification, when generating the financial bill. For further information on how to register a financial rule, refer to https://tdn.totvs.com/x/NBu9Gg

...